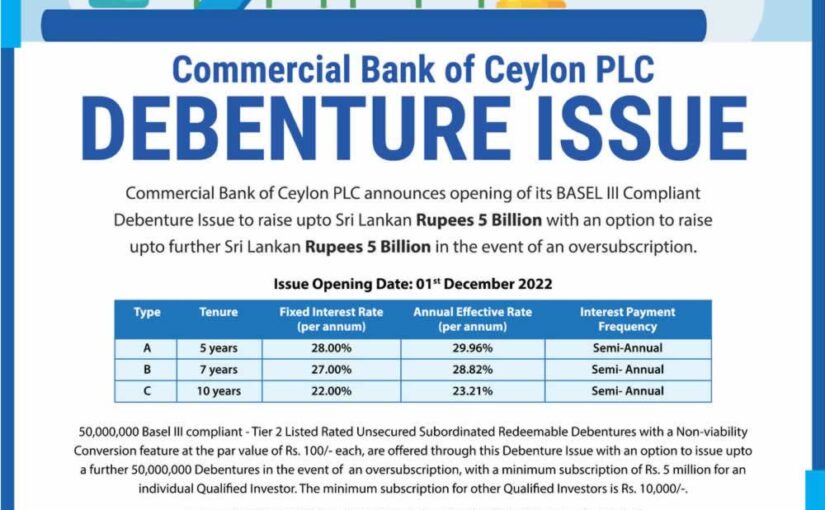

Commercial Bank of Ceylon PLC announces opening of its BASEL III Compliant Debenture issues to raise upto LKR. 5 billion with an option to raise upto further LKR. 5 Billion in the event of an oversubscription.

Issue opening date: 1st December 2022

| Type | Tenure | Fiexed Interest rate per Annume | Annual Effectie rate per Annum | Interest Payment frequency |

| A | 5 Year | 28.00% | 29.96% | Semi- Annual |

| B | 7 Year | 27.00% | 28.82% | Semi- Annual |

| C | 10 Year | 22.00% | 23.21% | Semi- Annual |

50 Million Basel III compliant tier 2 listed rate unsecured subordinated redeemable debentures with a non-viability conversion feature at the par value of Rs. 100 each. Are offered through this debenture issue with an option to issue upto a further 50 Million debentures in the event of over subscription.

With a minimum subscription of Rs.5 Million for an individual qualified investor. The minimum subscription for other qalified investors is Rs.10,000/-

For more details see below image or contact to Commercial bank treasury on 0112 486 347 or Investment Bankng 0112 486 492

Leave a Reply